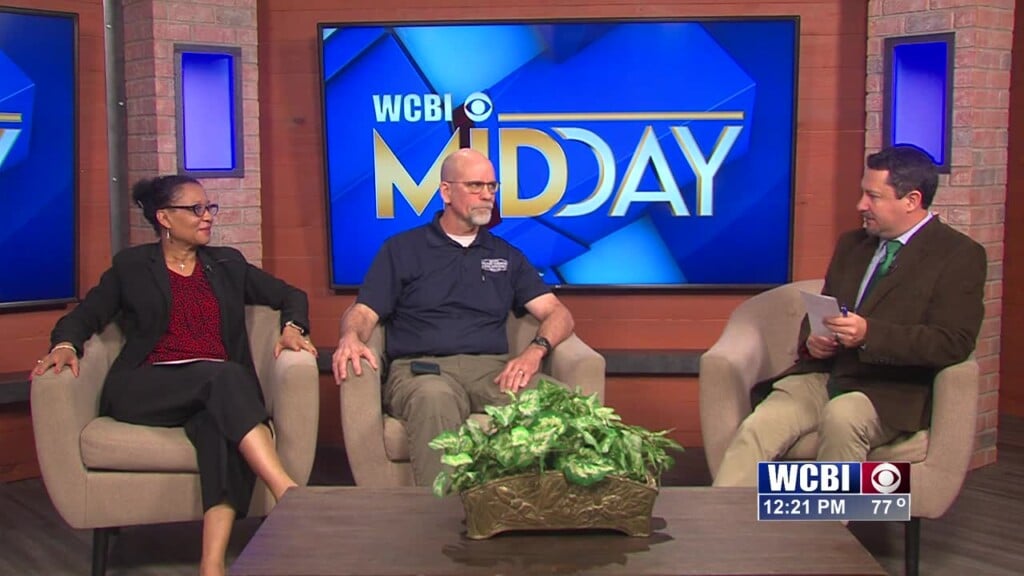

Storm Damage and Insurance Claims

COLUMBUS, Miss. (WCBI) – High winds topple trees and power lines, after a powerful storm system swept through the area this weekend.

Today, the clean-up continues, leaving many busy homeowners and insurance agents.

Mississippi Insurance Commissioner Mike Chaney wants anyone affected by weekend storms to file insurance claims, as quickly as possible.

“Suddenly, huge gusts of wind and then boom, boom, you know, the tree is coming down,” says Columbus resident, Jim Scott.

And here’s where it landed.

Two very big oak trees now swallow Jim Scott’s backyard in Columbus.

“That tree was snapped at the bottom, came down, hit our tree. Of course, our tree would have came down anyway with the storm, and so that one is on top of that one, and in the process, it took out limbs and branches from pretty much every tree in our backyard.”

Scott, who rents this home, doesn’t believe the house was damaged.

However, the fence was damaged.

One of the trees laying in his backyard, was his neighbors.

If it had fallen on Scott’s home, damage costs and repairs would fall in the lap of the person that owns the house.

“If the tree in your neighbor’s yard is healthy and an act of God blows it unfortunately, into your house, that’s one of those things your insurance company is typically going to take care of that and move forward with that process and filing that claim,” says State Farm Agent Rob Naugher.

Naugher says most insurance companies aren’t going to kick into play, until there’s actual damage.

“A lot of times, we’ll have situations where a tree falls on a fence and causes damage to the fence and things of that nature and of course, if it just falls on the roof of the house, so those are the things that we’re looking for.”

If your damage is different, look at your insurance policy.

“If a tree causes damage to the house, most insurance companies are going to pay whatever it costs to take the tree off the house and drop it to the ground, and then typically, most companies have a tree debris removal limit that’s going to be part of that particular claim process as well, and that’s kind of on a case by case basis, the adjuster would have to talk to them about what the policy language is and so forth.”

Leave a Reply