President Trump’s spending bill means extra deductions for those who rely on tips

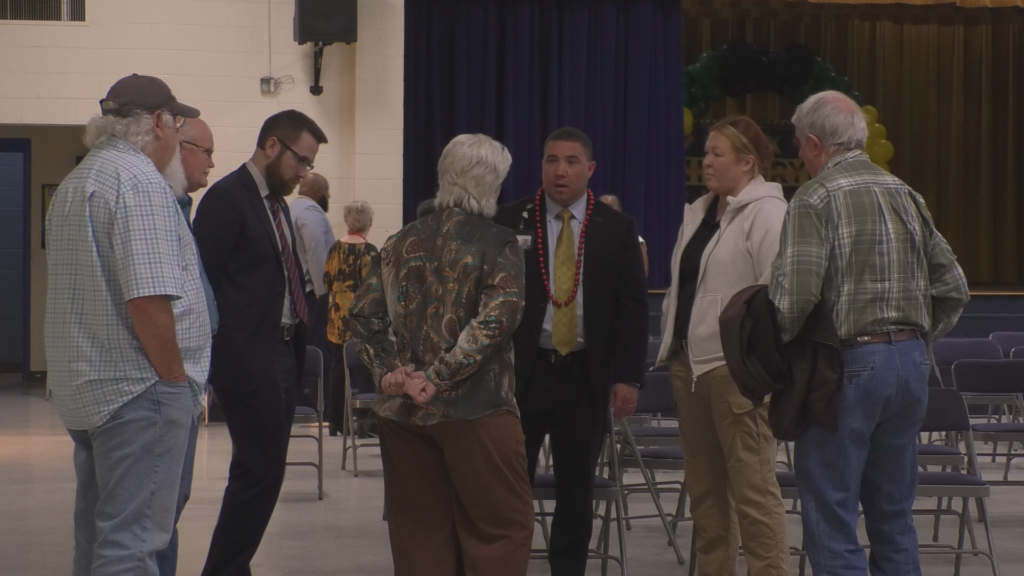

Congressman Trent Kelly and a local restaurant manager speak out on the proposal

TUPELO, MISS. (WCBI) – For months now, the no tax on tips proposal from President Trump has been on the minds of team members at restaurants, such as Harvey’s in Tupelo.

“There is a lot of uncertainty, I think most everyone is for it, obviously,” said Harvey’s Managing Partner Pat Campeau. He said waiters, bartenders, and others who rely on tips as a major part of their income have questions about the details.

“If there is no tax on cash tips, no tax on credit card tips, then our staff wants to report their income. If you buy a house, you need a history of income,” Campeau said.

The no tax on tips proposal would create a new deduction for workers who receive tips. A report from the White House Council of Economic Advisers estimates the average take-home pay for eligible workers would increase by $1,675 per year.

While Campeau said most transactions are made with a credit or debit card, the debate over no taxes on tips has not gone unnoticed by restaurant customers.

“We have seen people writing the tip on the receipt and giving the server cash. Where it is typically mostly credit card tips, we have seen a lot more cash lately,” Campeau said.

First District Congressman Trent Kelly said the no tax on tips is a no-brainer.

“No tax on tips, I can’t imagine, I think it is so important to do. Those are our truly working-class people, getting through college, feeding their kids, working an extra job, making a living. It is important we do that,” Congressman Kelly said.

A June survey found that 83% of hourly workers are in favor of eliminating taxes on tips.

The spending bill now goes back to the House for approval. President Trump said he will sign the bill as soon as it reaches his desk.