How Mississippi insurance companies can adapt to the rise in severe weather

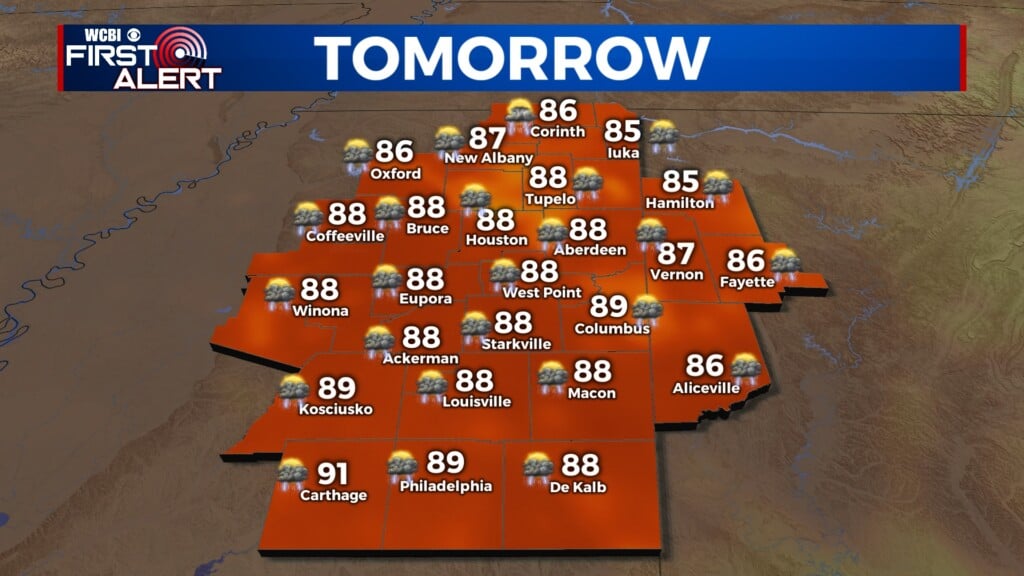

STARKVILLE, Miss. (WCBI) – The National Weather Service has confirmed that 15 tornadoes touched down in Mississippi on April 13, leaving plenty of damage in their wake.

As the state continues to weather through a stormy spring, Mississippi Insurance Commissioner Mike Chaney says to expect insurance rates to go up to about six percent.

“We understand the pressure with rates,” Chaney says. “If you’re on a fixed income, it’s hard when you get an increase and we’re looking at these huge increases coming for the National Flood Insurance program.”

According to the NWS, Mississippi leads the country with 422 reports of severe weather so far.

“The biggest effect on rates happens to be hurricanes and not tornadoes,” Chaney says. “Tornadoes are very destructive but small. Hurricanes are very huge and wide.”

Dr. Kieran Bhatia gave a presentation at Mississippi State’s Insurance Day program on Thursday titled, “Climate Change and Severe Weather: Ramifications for the Insurance Industry.”

“The Gulf of Mexico and the coastal states have some of the highest sea-level rise measurements in the world,” he says. “So that’s something that’s really important to understand, is that coastal erosion, flooding due to high tides and hurricanes are becoming much more likely in these locations.”

Dr. Bhatia is the Vice President of Climate Change Perils for Guy Carpenter, with a PhD in meteorology and oceanography. He discussed how studying the ongoing changes in the earth’s atmosphere can help predict the probability of severe weather in a given part of the country.

“If you don’t understand the likelihood of an extreme event happening and what hazard you’re most at risk for, you’re not going to be prepared for those hazards,” Dr. Bhatia says.

One of those proactive measures is having insurance companies offer discounts to homeowners with incentive programs.

“Give discounts and people would go in and fortify their homes,” Chaney says. “Things like trimming back that timber, like ensuring that the roof is in good repair. That gives you an incentive to give a discount to the consumer.”

The Mississippi Insurance Department says at least a dozen insurance companies on the Gulf Coast are offering incentive programs and expects it to spread north.

“With losses increasing, it’s so important that we have insurance as a protection when those big events happen,” Dr. Bhatia says.