These top economists just upped their odds of a recession

Some prominent economists think the rapid spread of the novel coronavirus could push the U.S. into recession this year, a darkening view that reflects growing concerns about the outbreak’s global impact.

Moody’s Mark Zandi on Monday increased the odds of such a downturn — usually defined as two straight quarters of shrinking economic growth — to about 65%, up from about 50-50 only a week ago. “I think it is very difficult to avoid a recession,” he told CNBC Monday. “The depth of the recession will depend on how the [Trump] administration reacts.”

Zandi isn’t alone. Economists who were early in seeing the financial crisis of 2008 are sounding the alarm. Worsening news about the spread of the coronavirus, as well as Saudi Arabia’s vow to boost oil production, caused panic in the markets Monday, with the Dow plunging more than 2,000 points in afternoon trading.

The typical reaction on Wall Street when stocks plunge is to preach calm, and some experts were doing just that. Top strategist Ed Yardeni said he believed growth would rebound in the second half. Former Goldman Sachs CEO Lloyd Blankfein tweeted on Monday that the economy remains strong and that investors should expect a quick recovery once health officials get a handle on the coronavirus outbreak.

But the number of prominent economists who are now using the “R” word seems to be growing. Here’s a rundown:

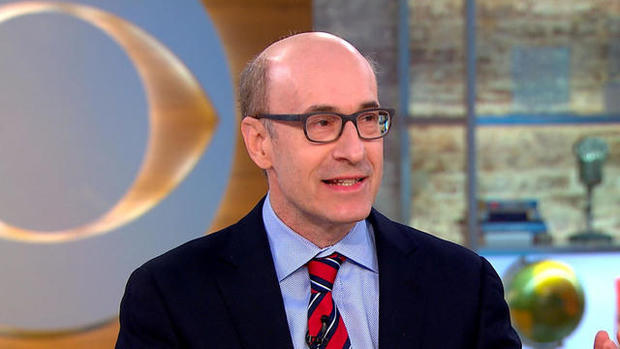

Nouriel Roubini

Why he’s important: Roubini is a top economic forecaster and a New York University professor. In 2008, he was one of the first to predict that the big bust in housing prices would cause a financial crisis and a recession.

Chance of recession in 2020: 66%

What he’s saying: Roubini, once known in media circles “Dr. Doom,” is again living up to his nickname. On Monday, he tweeted that plunging oil prices would tip the world into global recession. Roubini also predicted that a financial crisis resulting from a one-two punch of the coronavirus and a sharp drop in oil prices would be worse than the credit crunch of late 2015, which caused dozens of oil and gas drillers to go bankrupt. “Not just about energy but also other leveraged sectors; the COVID economic shock is real rather than a fear,” Roubini tweeted. “Recession/crisis ahead.”

Mark Zandi

Why he’s important: Zandi, a John McCain campaign adviser in the 2008, served as an economic adviser to President Barack Obama during the financial crisis. These days, he is seen as a leading economic forecaster and heads research firm Moody’s Analytics.

Chance of recession in 2020: 65%, up from 50% last week

What he’s saying: Zandi thinks the Federal Reserve will soon have to slash its benchmark short-term interest rates to zero, which is what it did as the financial crisis erupted in 2008. But that alone is unlikely to pull the economy out of a recession, just as in 2008. Zandi said we will likely need a stimulus package from Congress that President Donald Trump is willing to sign. “How deep the recession is will matter on the response of the administration,” Zandi told CNBC.

Zandi thinks falling oil prices aren’t the worst of it. He said the drop in gas prices within nine months will likely neutralize the effect of any layoffs from U.S. drillers and oil producers. The main problem is the forced slowdown of economic activity because of efforts to contain the coronavirus.

“Corporate managers are going to be very cautious and reluctant to let people travel and go back to normal,” Zandi said. “In the travel and retail market, I suspect we are going to see layoffs pretty quickly.”

Kenneth Rogoff

Why he’s important: Rogoff is a Harvard economics professor who among other achievements co-wrote a highly regarded book on the history of financial crises. He correctly predicted that the fall of Lehman Brothers would cause a prolonged recession.

Chance of recession in 2020: 50-50 for the U.S.

What he’s saying: Rogoff believes policy makers should start planning for a global recession. The biggest problem is that the outbreak and resulting fallout is hitting the global economy as growth was already slowing.

What’s more, Rogoff wrote last week, a coronavirus-driven downturn could be even worse than the Great Recession because it will hit supply chains, hurting a range of businesses, as well as sapping consumer demand. And if tens of millions of people are unable to get to work, that will make it difficult for companies to operate and continue to produce goods and services, he added.

“The new coronavirus, Covid-19, implies a supply shock as well as a demand shock,” he wrote. “Policymakers and altogether too many economic commentators fail to grasp how the supply component may make the next global recession unlike the last two.”

Ethan Harris

Why he’s important: Many economists don’t expect a recession this year, it’s worth noting. Harris, head global economist at Bank of America, is one of them. He has long been regarded as one of the best forecasters on Wall Street and was one of the few economists at a major bank who predicted a recession in 2008.

What he’s saying: Bank of America analysts have cut their expectations for economic growth this year. Harris now says the global economy will be the slowest it has been since 2009. But he thinks we can still narrowly avoid a recession. Overall, Bank of America is predicting 1.5% growth for the U.S. economy for the year, down from 2.3% in 2019.

Harris does see a big risk that a coronavirus-fueled slowdown could create “severe financial distress” for some companies and their workers. But he thinks the best remedy for that would be some kind of government assistance program, not lower interest rates courtesy of the Fed.

“The bottom line is that investors should not be counting on central banks to save us from the virus shock,” Harris wrote in a note to investors last week.

Leave a Reply