Fidelity reviewing ties to Ken Fisher after sexist comments

- Fidelity Investments said it’s reviewing ties with billionaire money manager Ken Fisher after his “highly inappropriate comments” at a conference last week.

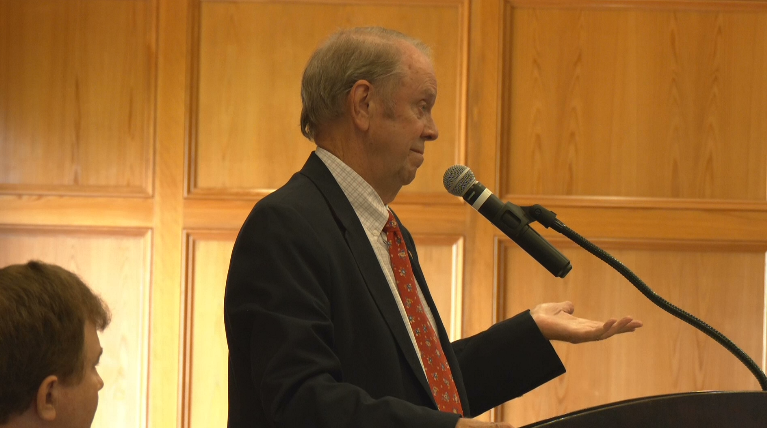

- Fisher, who had spoken at a $25,000-per-head conference, compared signing a new client to “getting into a girl’s pants” and mentioned genitalia.

- Fisher manages about $500 million for Fidelity.

Money management giant Fidelity Investments said it’s reviewing ties with billionaire Ken Fisher following sexist comments he made last week at an exclusive investor conference. Fisher, who manages about $500 million for Fidelity, had compared signing a new client to “getting into a girl’s pants” and mentioned genitalia.

“We are very concerned about the highly inappropriate comments by Kenneth Fisher,” Fidelity spokesman Vincent Loporchio said in an emailed statement. “The views he expressed do not align in any way with our company’s values. We do not tolerate these types of comments at our company. Fidelity Strategic Advisers is reviewing this relationship.”

Fisher, who has an estimated net worth valued at $3.7 billion, sparked a furor with his October 8 comments at the $25,000 per-head conference, with some attendees pointing out that his sexist remarks reflect the difficulties that women face within the investment management industry. Women represent only 4% of top executives at mutual funds, hedge funds and other investment vehicles and they control just 1% to 3.5% of fund assets under management, according to the Harvard Business Review.

Trending News

A few days ago, Michigan State broke off its relationship with Fisher Investments, according to the Washington Post. Fisher Investments had managed $600 million of the state’s pension funds.

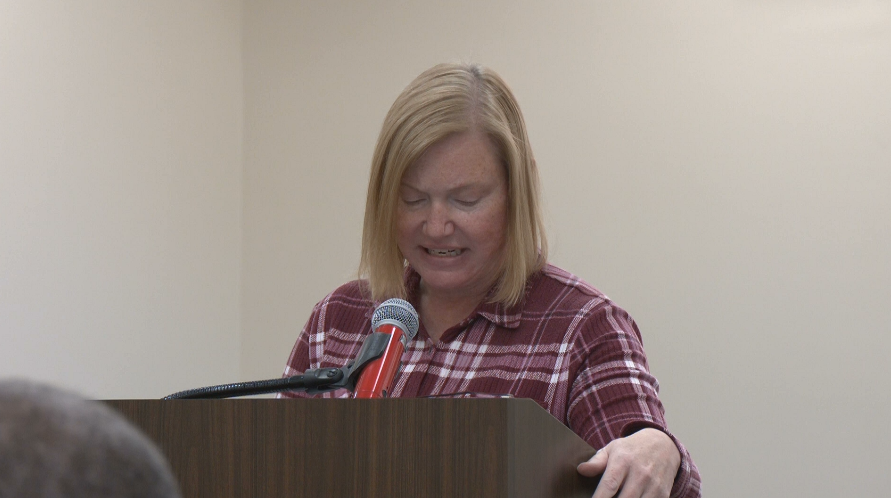

Both men and women attending the conference were “disgusted” by Fisher’s comments, said Alex Chalekian, founder of investment firm Lake Avenue Financial, who posted a video on Twitter about his experience at the conference.

Leave a Reply