Secure your device and stop hackers in their tracks

LOWNDES COUNTY, Miss. (WCBI) – Technology is continuously updating.

With face recognition, Touch-ID, and passcodes – keeping our devices secure is a top priority.

But even with enhancements, hackers seem to make their way into our phones.

It seems as though anyone can find personal information that we put in our cellphones.

However there are ways, like updating your passwords, that can help decrease the chances of your phone and information being hacked.

In today’s world, we are constantly plugged in for hours on our cellphones. A lot of times, our phones hold personal information. Sometimes, that information gets into the wrong hands.

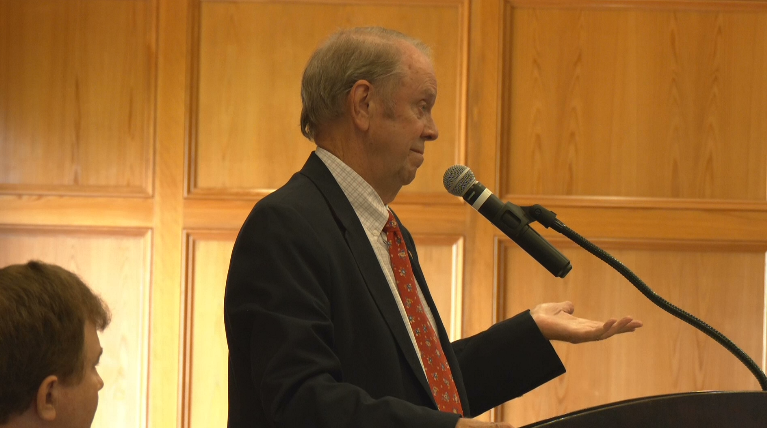

“On Apple specifically, it’ll send you a notification if someone is trying to access your information,” said the owner of Cellphone Repair Geeks Ben Mitchell.

Mitchell said that on Apple devices you can protect your device with a few security options.

“You want to probably add two-factor authentication to your phone that way if someone is trying to hack information they have to get a code,” said Mitchell.

A code that you, the user, already have set up.

Mitchell also suggested changing your passwords often.

“Reset the AppleID passwords specifically, go into your email and reset the email passwords. If they’re the same as that password I’ll go ahead and reset Facebook, Instagram, Snapchat all that kind of stuff,” said Mitchell.

Mitchell said making your password tricky is key when it comes to keeping potential hackers out.

“Six digits is about 100 times harder to hack into. If you wanna be even safer, add the alphanumeric. You can change it to where you can put any custom word. It makes it even more difficult to get into it,” said Mitchell.

Many smartphones allow us to store debit and credit card information. Ensuring you have a secure login lessens the chances for your money to be stolen.

Cadence Bank Branch Manager Shelley Clark said they have a team that monitors accounts for possible fraudulent charges.

“Any suspicious activity, if you live in Columbus and you do a lot of traveling you need to notify the bank. If you’re going to California for a business trip, you need to let the bank know so they can let the transactions go through if you plan on using your card because if not they’ll actually decline the charge thinking it’ll be a fraudulent item,” said Clark.

With personal information easily accessible nowadays, Cadence Bank has an account designed specifically to help repay people back within 60 days, if their account was compromised.

“If it is something that you didn’t authorize, you get that provisional credit so you get it back immediately once you fill out the dispute,” said Clark.

A good rule of thumb both Clark and Mitchell said is to change your passwords every three to six months.

Leave a Reply